Crypto Recap: February 4, 2025 – Market Swings, Legal Battles, and Price Predictions

Yesterday, the crypto market experienced its typical volatility with significant moves in both price action and regulatory developments. From Bitcoin’s minor setback to an intriguing lawsuit and some daring price predictions, here’s a rundown of the biggest stories from February 4, 2025.

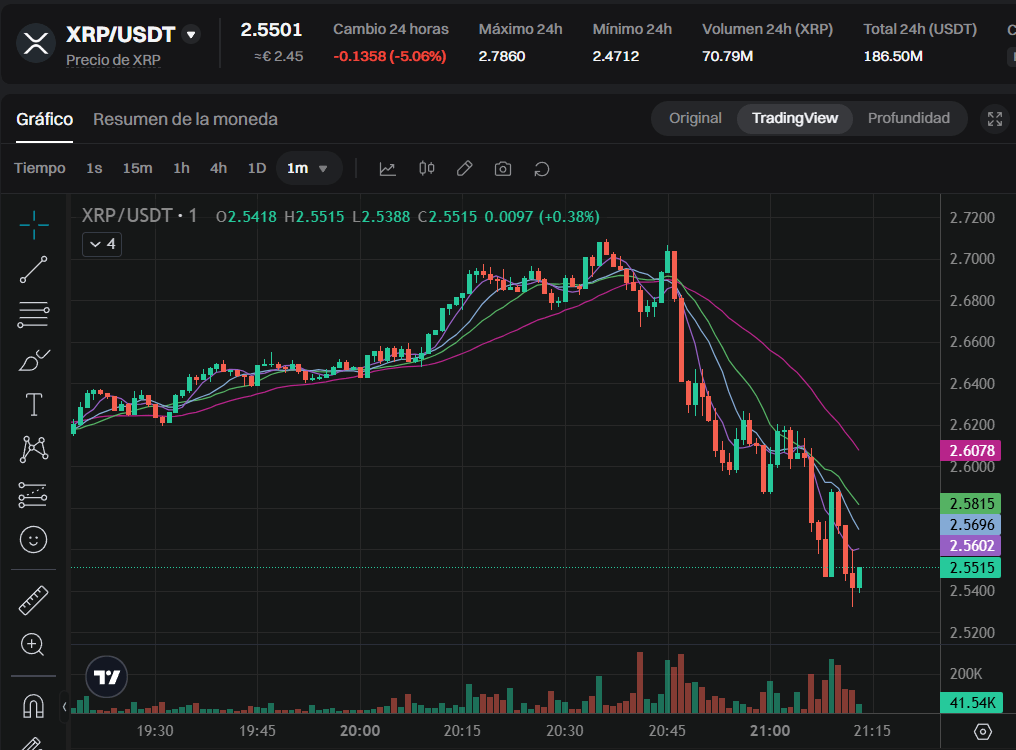

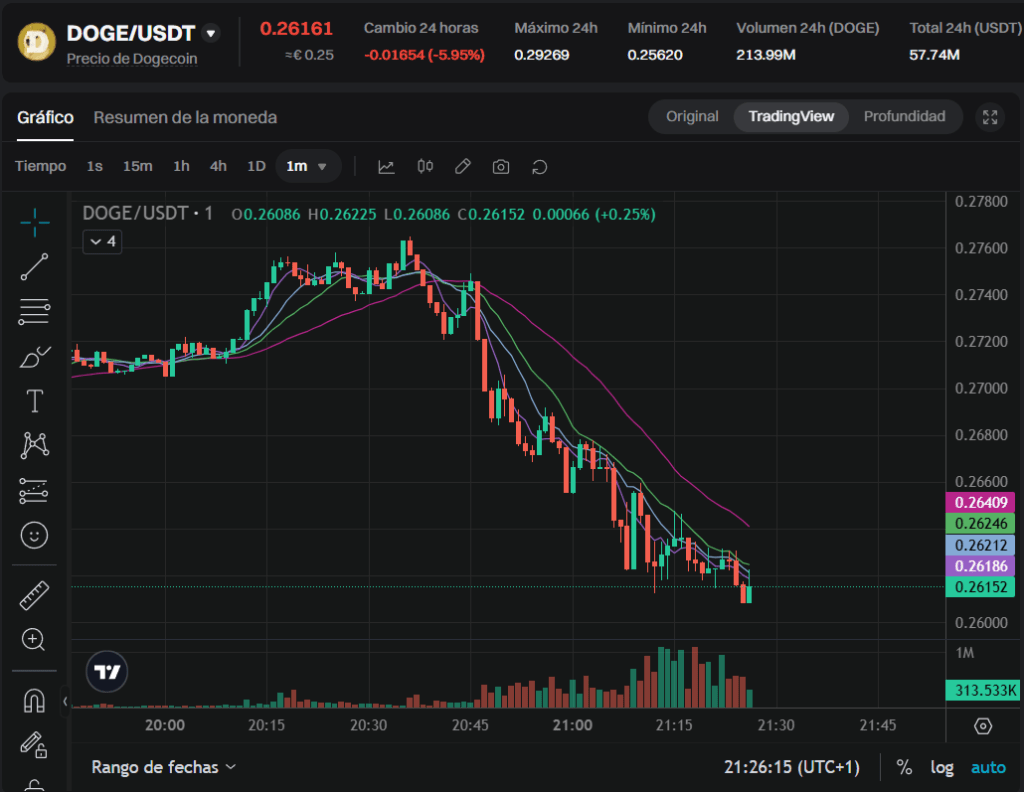

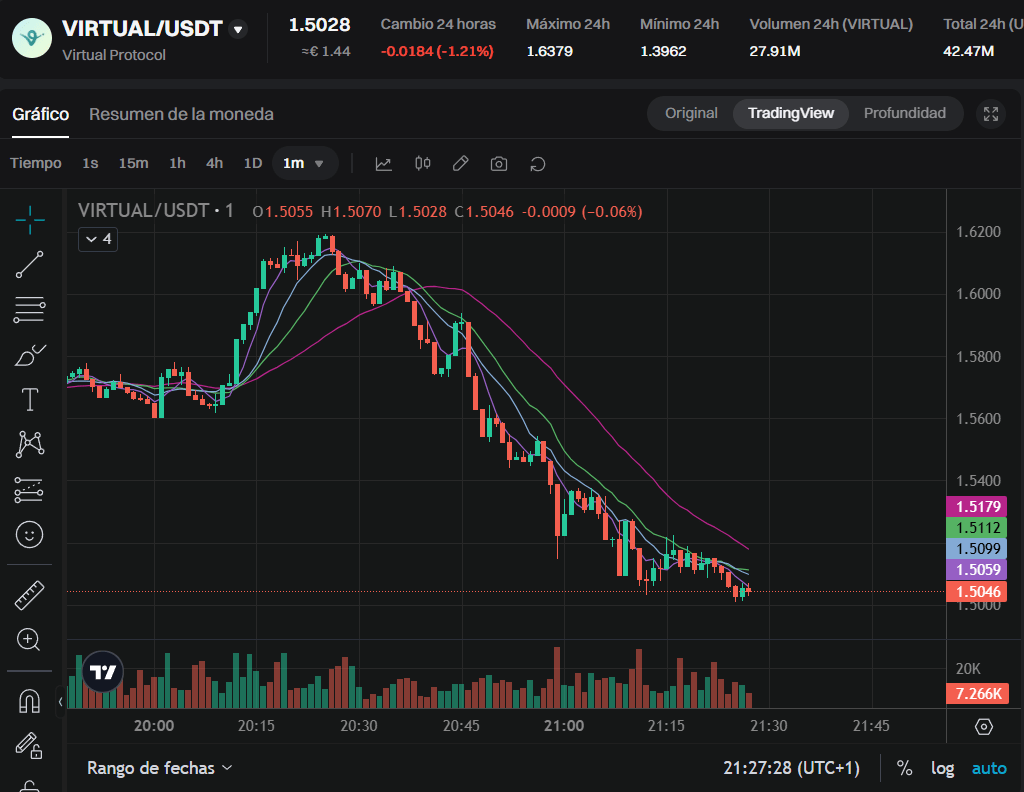

Market Shake-Up: Sentiment Tumbles Amid Regulatory Concerns

The day began on a cautious note as investor sentiment faltered due to increasing regulatory pressure in major markets. The U.S. Securities and Exchange Commission (SEC) announced a crackdown on several DeFi platforms, sending ripples through the crypto community. Bitcoin slid down 3% to just under $94,000, while Ethereum saw an even sharper decline of 7%, dipping below $2,350 before pulling back slightly. Altcoins, particularly those tied to decentralized finance (DeFi), were also hit hard, with some losing as much as 10% in a matter of hours. The market as a whole lost roughly $300 billion in value, highlighting how sensitive the crypto space remains to regulatory news and external factors.

While traditional financial assets struggled with the news, crypto-focused firms also felt the pressure. Binance’s stock dropped 5% as the exchange faced heightened scrutiny, and companies that have a significant DeFi presence, like Aave and Uniswap, experienced similar declines. However, as the day wore on, crypto prices stabilized after reassurances from U.S. lawmakers that the regulatory situation may not escalate further.

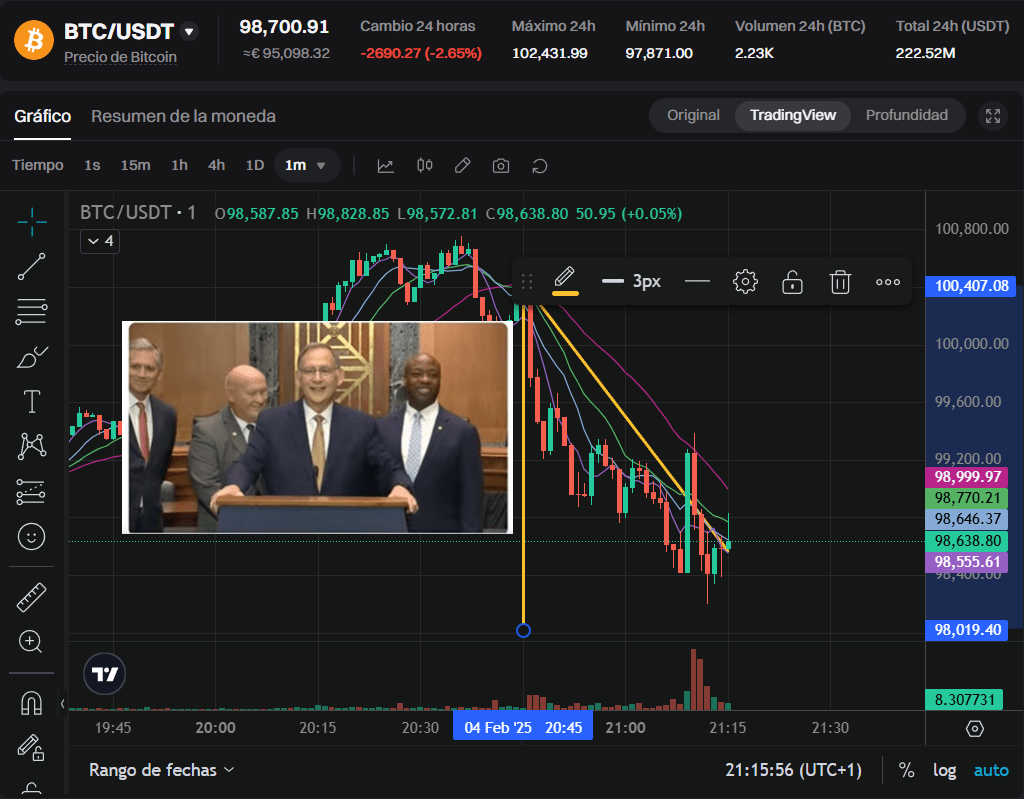

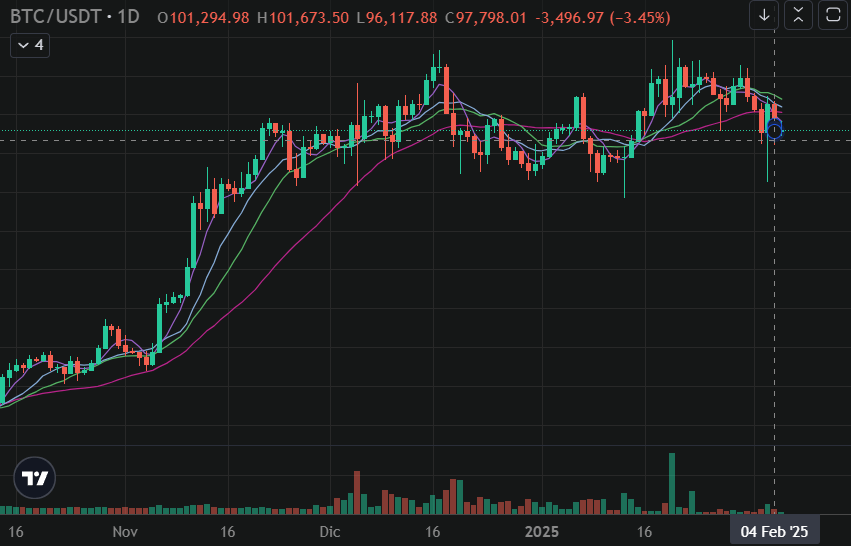

Bitcoin: A Mild Dip, But Resilience Shines Through

Bitcoin, despite the broader market downturn, showed resilience. After its 3% dip, Bitcoin managed to bounce back, finishing the day around $94,500. The dip was largely attributed to a wave of uncertainty regarding the SEC’s stance on DeFi projects, with traders flocking to cash in their positions. However, experienced investors were quick to swoop in, taking advantage of the lower prices and pushing Bitcoin’s price back above $94,000 by the close of the day.

Some analysts are seeing the price drop as a healthy correction, indicating that Bitcoin remains in a strong uptrend overall. Despite these temporary pullbacks, many traders continue to hold onto their bullish outlooks, believing that Bitcoin’s long-term potential remains unchanged, especially with the halving event drawing closer.

Legal Drama: Mt. Gox Trustee to Release 140,000 BTC

In legal news, another story with major implications for the market emerged. The trustee handling the bankruptcy case of Mt. Gox, one of the most infamous crypto exchanges, announced that it would begin releasing the remaining 140,000 BTC it has held since the hack in 2014. This decision comes after years of delays and controversy surrounding the distribution of these funds to creditors.

This news sent shockwaves through the market, sparking concerns that the sudden influx of Bitcoin could put downward pressure on prices. However, some analysts believe the impact will be limited, given the long time frame over which the release will occur. Still, the move has reignited debates on how historical events like the Mt. Gox hack continue to cast a shadow over the market, even as the crypto ecosystem matures.

Crypto Law Enforcement: Another Case for Transparency

In another legal story, the infamous crypto exchange Bitfinex was slapped with a lawsuit accusing it of violating U.S. money laundering laws. The suit, which claims that the platform enabled transactions linked to illicit activities, has reignited conversations about the need for greater regulation and transparency in crypto operations. Although the exchange has denied the allegations, the case serves as a stark reminder of the challenges crypto businesses face in maintaining compliance.

Legal experts are watching this case closely, as it could set a precedent for how crypto exchanges are regulated in the U.S. in the future. If successful, the lawsuit could spur tighter regulatory measures on crypto exchanges globally, potentially altering how businesses in the space operate moving forward.

Price Predictions: $150K Bitcoin by Mid-Year?

Despite the regulatory drama and market dips, some crypto analysts remain unshaken in their predictions. Well-known investor and analyst Sarah Lee is making headlines with a bold forecast that Bitcoin could reach $150,000 by mid-2025. Lee’s prediction is driven by her belief that institutional investment will continue to pour into the space and that the upcoming Bitcoin halving will significantly reduce supply while increasing demand.

Lee’s forecast has stirred up conversations, with some industry leaders expressing caution while others are enthusiastic about the potential for another bull run. While such price predictions are often speculative, the possibility of Bitcoin reaching new all-time highs in the coming months is a tantalizing thought for many traders and investors.

Final Thoughts: The Crypto Roller Coaster Continues

February 4, 2025, was another reminder of just how unpredictable and exciting the crypto world can be. Regulatory challenges, legal battles, and bold price forecasts made for a wild day in the market. But through it all, one thing remains clear—crypto’s volatility, while daunting, is also what makes it so fascinating. As always, the space continues to evolve, and with it, the potential for both risk and reward. For anyone keeping an eye on crypto, yesterday’s events underscore the need to stay nimble and informed. After all, in the crypto world, things can change in the blink of an eye.

Leave a comment